The Ultimate Guide to Uncategorized Expenses

Estimated Reading Time: 22 minutes

Introduction

Accounting professionals have so many things to take care of. From standard recurring tasks to putting out fires, we’ve found one thing that causes headaches for accountants and clients alike: uncategorized transactions. Thankfully, this can be easily remedied with a simple, solid approach to managing uncategorized expenses, uncategorized income, and uncategorized assets.

It sounds so easy, but any accountant or bookkeeper can tell you about the *pain* that can be involved in tracking down the information that’s needed to wrap up month-end or year-end close.

The benefits to proper uncategorized transaction management are clear: time savings, cost savings, better reporting, fewer audits, tax advantages, happy clients, happy accountants and bookkeepers, and a healthier bottom line.

But where do you start? Is there a better process than exporting and sending spreadsheets? How do you save more time and fix uncategorized transactions while staying accurate? Do other firms struggle with this? What tech is available? In other words, is there an app for that?

Uncat is here to help. Our origin story starts with working with TwoRoads, an Intuit “Firm of the Future,” where we identified a common, headache-inducing problem: there’s no easy way to get uncategorized transaction info from clients and get that into our accounting software… why is that? We worked with the Two Roads team to solve it by building simple yet powerful software that’s an easy value-add for accounting firms, bookkeepers, and clients.

You could say we’ve learned a thing or two about this topic by working with thousands of accounting professionals over the past few years. And since we’re rooted in accounting and bookkeeping tech and its surrounding culture, we understand the pains, the time wasted on email after email, the updates to spreadsheet after spreadsheet, and the rework. It’s draining and it’s no fun for clients either. It’s why we built Uncat to fix all that.

And while we’ve been busy improving Uncat, applying customer feedback to make it even better, and growing with our customers, we’ve also been creating a lot of helpful content about accounting and bookkeeping; especially about how to solve the problem of uncategorized transaction management. In this brand new blow-the-walls-out resource, you’ll find a quick overview of several topics, links to a plethora of resources from the Uncat blog that dive deeper, downloads to help you manage your internal processes, and more.

Let’s start with a view of the playing field…

What is an uncategorized expense?

An uncategorized expense is any expense that appears in a transaction record (typically within an accounting software like QuickBooks Online, Xero, or QuickBooks Desktop) that does not have an accounting category attached to it (e.g. meals and entertainment, software, cost of goods, etc.).

These are especially problematic for accountants and bookkeepers because they rely on categorization to properly maintain accounting records and tie expenses to specific accounts in the general ledger. It’s impossible to properly manage and close books without accurate expense categorization.

For example, a charge appears in the transaction record for $41.25 at Amazon. An accounting professional has no way of knowing if that charge was for office supplies, a book or training resource, a gift card, or something else. And since they can’t tell what the purchase was for, they cannot accurately categorize the transaction and charge it to a specific account. The end result is the business the accountant is trying to serve ends up with inaccurate books, and it’s frustrating for both parties.

A super-brief history of uncategorized expense management

As you can imagine, the analog days of uncategorized transaction management were highly manual and relied heavily on written and verbal communication. Accounting teams kept paper ledger books - no Excel, no phone, no email. You just tried to stay warm by that pitiful fire in Ebenezer Scrooge’s office with some handwritten notes about categorization and what you could remember from your last meeting with the client.

Before the advent of basic computing and connectivity, bookkeepers relied on handwritten records, and delays could be extensive. The ability to scale accounting systems was also limited, but 1969 welcomed LANPAR’s groundbreaking evolution: the first digital spreadsheet. They may seem boring, but spreadsheets became an integral part of information management across industries, and they continue to be a staple to this day.

But overall, things didn’t really change that much for uncategorized expenses and deposits.

You still needed information from clients.

You still had to export that information in spreadsheet form, send it over, wait, send a follow up email, wait some more, and get a half-completed sheet back.

And then you did it again.

In fact, that’s how many bookkeepers and accountants still do it today.

Even with the proliferation of self-serve accounting software like QuickBooks Online where users can add their own categories and easily attach those to expenses, users still find it hard to enter the information. And where a business has engaged a bookkeeper, accounting firm, or CPA to handle their books, it’s still a tug-of-war at times to get accurate information from clients using the spreadsheet-email-spreadsheet process we mentioned above.

Terms to know

As we continue, it’s also helpful to know more about the accounting vernacular surrounding uncategorized transactions. We defined uncategorized expense above, but here are a few terms and definitions that should help.

Uncategorized Income: Any income or deposit that appears in a transaction record (typically within an accounting software like QuickBooks Online) that does not have an accounting category attached to it or, sometimes in the case of a payment for an invoice, remains in an unmatched state. Even with automated payment solutions in place, a deposit can enter your account with no information about its origin (was it a payment for an invoice? a refund?).

Uncategorized Transaction: an all-encompassing term referring to both income and expenses that are not properly categorized in an accounting system. See definitions for uncategorized expense and uncategorized income above.

Bookkeeper vs Accountant: An accountant is typically charged with monitoring a business’ overall financial health. An accountant may have earned the designation CPA (Certified Public Accountant). Accountants also play an advisory role to other business leaders, lead tax functions, and help businesses navigate decision making processes and obstacles. Bookkeepers are accounting professionals who manage the day-to-day financial functions of a business (e.g. running payroll, cutting checks, making deposits, categorizing transactions, closing the books each month, etc.). Both accountants and bookkeepers can work independently, as part of a small or large accounting firm, or work on internal accounting teams at SMBs or Enterprises.

Suspense (Xero): This is the default uncategorized account in Xero, a popular cloud accounting platform.

Popular Accounts in QuickBooks Online: Each accounting platform may have its nuances, so it’s helpful to be aware of each platform's unique terminology. In the case of QuickBooks Online, default account types are listed as Uncategorized Expense, Uncategorized Income, and Uncategorized Asset. The names can be changed, but the accounts can't be deleted. Uncat automatically looks for these and suggests them to you when you're adding a new client to Uncat.

Ask My Accountant: This is what the main uncategorized expense account in QuickBooks Online used to be called. Uncat automatically looks for it, too. It also looks for any account with the word "Ask" in it since many firms create accounts like “Ask Client” or “Ask Brandon, Ask Sally, Ask Ryan.”

Obviously this isn’t an exhaustive list of terms related to accounting and bookkeeping, so make sure to consult appropriate knowledge bases for your accounting software to ensure alignment between how the platform treats and categorizes transactions and how you talk about them at your firm.

Pros and cons of manual uncategorized expense management vs Uncat

Believe it or not, there’s a time and a place for manual processes. But even resource-constrained small businesses or emerging accounting firms can benefit from uncategorized expense management software; especially when it’s really affordable and can shed hours of work off an already taxed team.

Some potential pros for the manual approach include:

High-touch access to account details

Extreme communication (phone calls, emails, etc.)

Leverage existing systems if you’re capital constrained (i.e. use a spreadsheet)

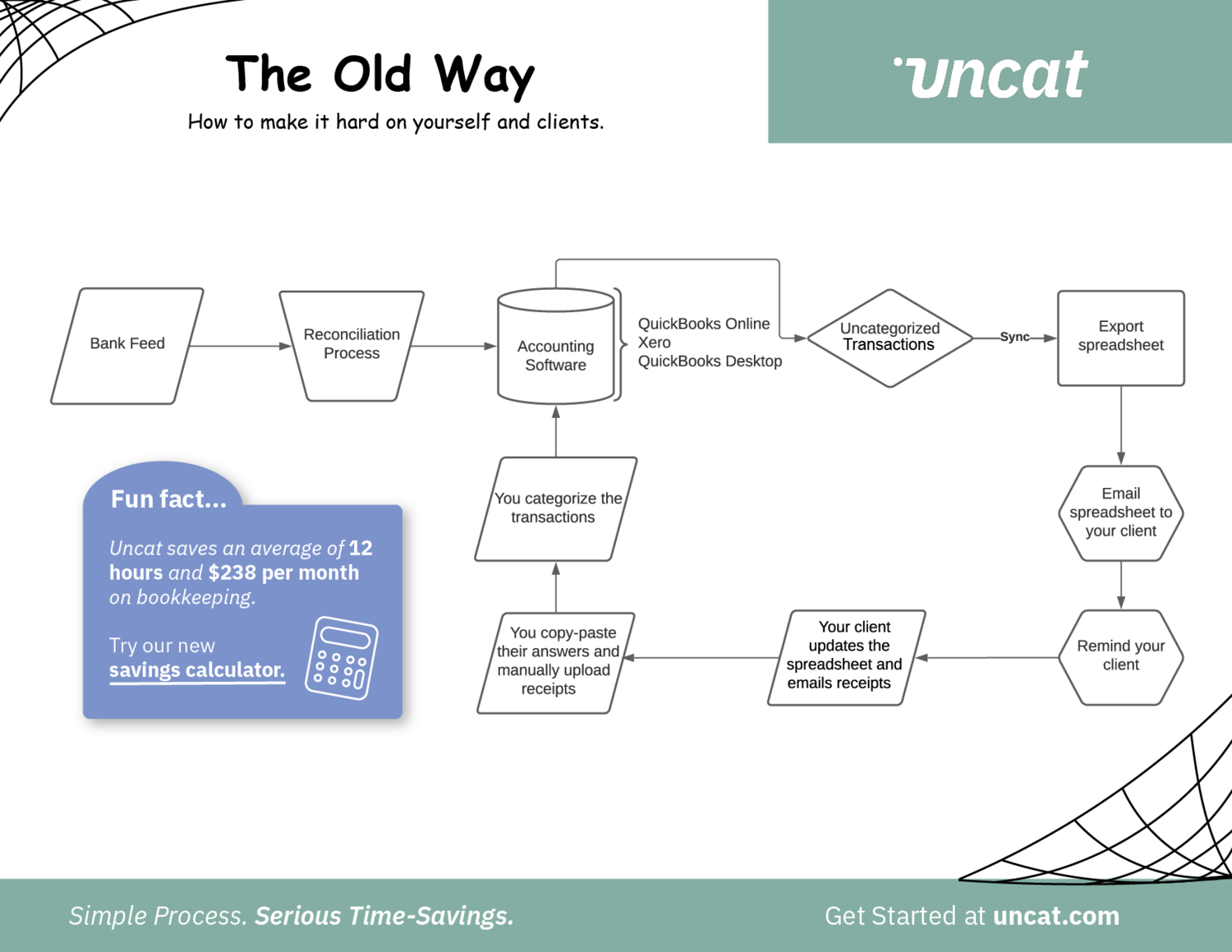

But often accountants and bookkeepers who rely on manual process will find themselves in a predictable pattern that might look something like this:

Uncategorized transactions appear in the accounting platform

You export a spreadsheet, format it, and send it in an email to the client

You follow up with the client

You follow up again

You receive an email saying the client is working on it

You follow up again

You receive a partially completed spreadsheet

You follow up again

You get the point

It’s a frustrating process that complicates an otherwise simple request.

That’s where Uncat’s super-simple, automated approach is freeing and effective. Here are some pros to using modern uncategorized transaction software:

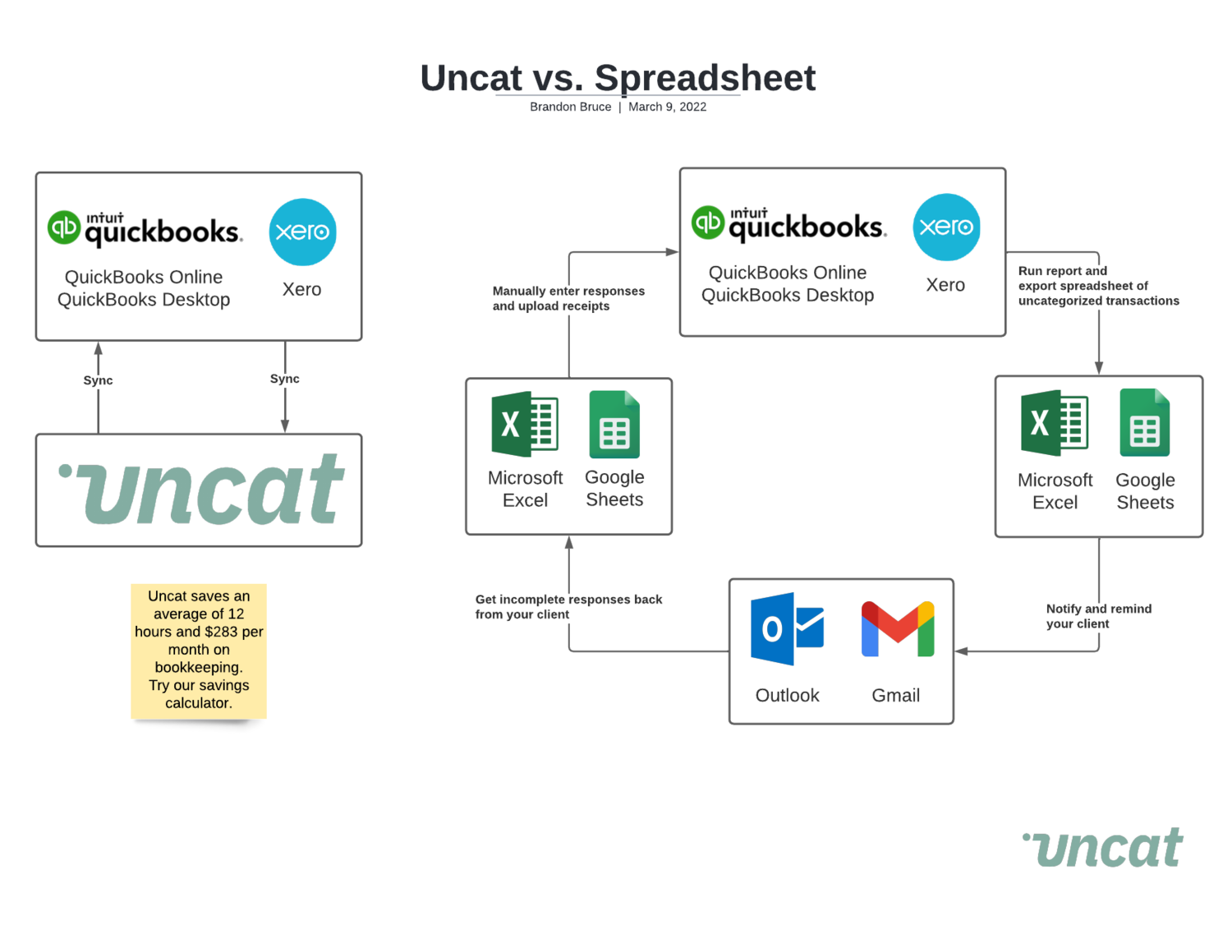

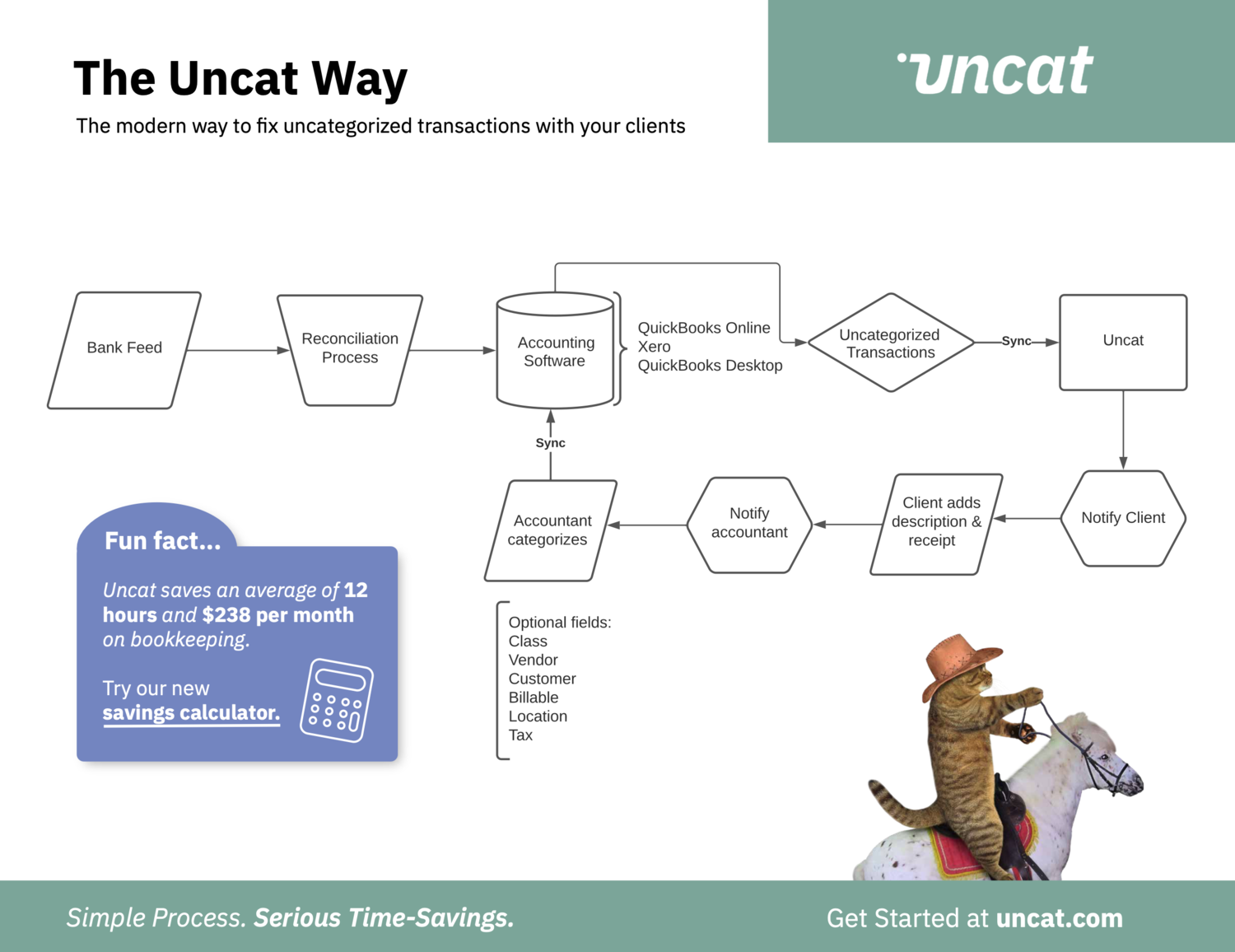

Uncat syncs uncategorized transactions from QuickBooks Online, Xero, and QuickBooks Desktop.

Uncat automatically notifies your client when there are transactions that need answers.

Your client enters descriptions and uploads receipts via Uncat, which syncs to your accounting software.

Uncat notifies you when your client has updated transactions so you can review and categorize in Uncat.

Uncat syncs your selections to your accounting software so you can close the books.

Uncat saves an average of 12 hours and $283 dollars per month on bookkeeping. Check out our time savings calculator.

Sounds better to me 😅. Getting automation on your side is a major win as you add time and mental bandwidth back to your day.

Now that we have a better view of the playing field, let’s dig a little deeper into uncategorized expense and income management.

Table of Contents

Benefits of effective uncategorized expense management

Processes for managing uncategorized expenses

Saving time on uncategorized expenses

Fixing uncategorized transactions

Technology to help with uncategorized expenses

A community identifies a solution to fixing uncategorized expenses

Benefits of effective uncategorized expense management

Date, amount, and category: these three basic identifiers are inherent to any accounting system. When did you spend it (date)? How much (amount)? What was it for (account / category)? The first two are relatively easy to identify (just log into QuickBooks Online). But it’s that last one that’s the sticking point.

You can’t read their minds.

But why is it important to categorize? For starters, proper categorization enables accountants and bookkeepers to pre-empt or answer audits, file taxes accurately, and get the benefit of available deductions and credits. Having accurate information about transaction data provides a knowledge base from which accounting professionals generate accurate financial reports like budgets, profit and loss statements, and balance sheets.

Having the right tools for categorizing transactions is also an important consideration. Many accounting pros wind up using a spoon where a hammer is needed: they’re relying on the wrong tool for the job. Spreadsheets just weren’t made for uncategorized transaction management.

You simply can’t run an effective business without categorization because you’ll never be able to clearly see account relationships, thresholds, and then use those data to drive decisions. Taming uncategorized transactions helps you get a grip on income and expense and build a better management and reporting system that improves the way a business operates.

For a helpful side-by-side comparison showing a legacy approach to categorization and a newer, better way, check out Two Ways to Manage Uncategorized Expenses: A Side by Side Comparison.

There’s also the stress and hassle uncategorized expenses and income bring to an accounting team. The back and forth, the spreadsheets, the extra communications all add up to a drag on resources, and even the client relationship could be strained as bookkeepers may be viewed as “nagging” when they’re just trying to do their job. No bueno.

Processes for managing uncategorized expenses

Nothing like a good process. I mean, who doesn’t love a standard operating procedure (SOP)? Maybe you don’t, but they sure take the guesswork and cognitive friction out of our work. Legacy processes that are all-too-common in accounting circles are often manual in nature and may need to involve the help of several accounting team members and client staff.

A good starting point for evolving your firm or business might be to:

Set up a process for month end close,

Create and reference a year end checklist to stay on track throughout the year (and guide end of year activities),

And make sure to set up a method for dealing with uncategorized transactions.

Get a head start with your free copies of The Uncat Month-End Close Checklist and The Year End Accounting Checklist from Uncat.

Uncat is a great tool specifically designed for getting the info you need about uncategorized income and expenses. Uncat happily works behind the scenes to automatically do the leg work of chasing commentary and categorization information.

You can even use it to implement a simple, conditional process: when transactions come in from the bank feed, they can be moved to uncategorized manually by the accountant or by a rule set up by the accountant in QuickBooks Online (e.g. automatically move all Amazon purchases to uncategorized to get information about the purchase from the client).

Saving time on uncategorized expenses

This is where the rubber meets the road, right?

Your schedule is full already, and accountants and bookkeepers work really hard to keep their clients’ finances in order. Unfortunately, not all of that time is spent as effectively as it could be:

First, clear communication is critical. If your clients don’t know what to expect, and they’re unsure about how your processes work, it’s only logical that they’ll be scrambling when you ask them for more information about all those charges. So make sure to be clear with them up front: this is how we do this, this is what we expect from you, this is how we’ll communicate, etc.

Second, by pulling the right software into the mix, automatic syncing and automated client notifications can help the average accounting firm pull its accountants and bookkeepers out of the weeds of manual categorization and put them back on track with more profitable work. Saving time, and better, saving frustrations around uncategorized transactions is something worth taking a look at. It’s an ROI calculation. How much time and money could you save on more effectively managing uncategorized expenses and income?

Fixing Uncategorized Transactions

We can do this the easy way. Or the hard way.

No, we’re not going to watch an old mobster movie. But this dichotomy shows up everywhere in accounting. Uncategorized transaction management is no different. For you visual types it might look something like this:

Transactions can’t linger around in an uncategorized state forever; in fact, your ability to close the books and create the financial statements the client depends on are tied directly to this activity.

So why do so many clients wait until the last minute or only provide partial answers?

Maybe it’s because you’re doing this the hard way. Using spreadsheets to communicate and track client responses and then manually copying and pasting those into your accounting software sounds like something from the 90s, and you’re totally cooler than that.

Curious about how other accountants and bookkeepers are dealing with uncategorized transactions? Check out our latest ebook, “Tracking Trends: Insights Into Uncategorized Transaction Management.”

Here’s a starter method for fixing uncategorized transactions. Add to it and make it your own.

Ensure you have a clear process in place for daily, weekly, monthly, quarterly, and yearly accounting expectations for accountants and bookkeepers at your firm

Work with your clients to get an overall picture of their business

Identify recurring transactions and set up rules in the accounting software to automatically categorize those

Set up Uncat to keep all of the uncategorized expenses and deposits in check (resource: The Modern Way to Fix Uncategorized Transactions)

Clearly communicate expectations to your clients about how you’ll be managing recurring transactions, uncategorized transactions, reporting, etc.

Watch Uncat herd the cats and fix uncategorized transactions for you while you sip tea

Kidding on that last one, but it really is pretty simple.

Technology to help with uncategorized expenses

Thankfully, technology has evolved at a rapid clip. Gone are the days of yelling for a family member to get off the phone so you could use the internet, software as a service has become a staple, and accounting firms are making changes to keep pace with technology adoption.

The term “tech stack” has become part of the vernacular, and it’s a best practice to align your business’ accounting needs with the right mix of tech tools.

Key to every tech stack is general ledger software. This is the heart of the system. All transactions eventually make their way here (categorized or not), and making sure this component is running correctly is critical to your success.

What if your general ledger software automatically received updates from the client about uncategorized income and expenses?

Hmmm.

It’s not that far-fetched. One key component that may be missing from your arsenal is uncategorized expense management software. Think of this as a friction reducing component that frees up your team, saves time, and makes the job of herding cats easier. Before selecting a software solution for categorization, make sure to read reviews and talk to other accountants.

Resource: Build the Best Accounting Firm Tech Stack for your Business

While approaches to tech stack construction differ, you’ll usually find a core of technologies that would be useful at any accounting firm:

GL accounting software (QuickBooks Online, Xero, etc.)

Expense management and receipt software (Expensify, AutoEntry, Hibdoc, and more)

Practice management software (Karbon, Canopy, Aero Workflow, Financial Cents, and others)

Task and project management tools (ClickUp, Asana, Airtable, and Trello to name a few)

Reporting and analytics (Fathom, Syft, Reach Reporting, etc.)

Uncategorized transaction management (Uncat, Microsoft Excel)

Quotes and contracts (PandaDoc, Proposify, Honeybook, RFPIO)

Bill payments (Bill.com, Ramp, QuickBooks Online, and more)

Taxes (UltraTax CS, Lacerte, Wolters Kluwer, and others)

Payroll (Gusto, Paychex Flex, etc.)

Inventory management (Fishbowl, Brightpearl, and more)

CRM, sales, and marketing (HubSpot, Front, Mailchimp, Buffer, Hootsuite, etc.)

Time tracking (Everhour, Harvest, ClickUp, and others)

Internal communication (Slack and Teams)

Some softwares come with built in analytics like Uncat, while others require integrations and more complex buildouts to extract the data you need in a meaningful way. For some use cases, multiple streams of data are pulled together into an analytics platform like Tableau.

Depending on the platform, you can even dive deeper to obtain certifications (make sure to get Uncat certified), growing your knowledge of how to tie it all together.

Bottom line: all of these tools can harmonize your work, help you scale, and deliver client satisfaction.

A community identifies a solution to fixing uncategorized expenses

We’ve spent a lot of time talking about the pros and cons of manual versus automated uncategorized transaction management, thought about saving time and energy on chasing information from clients, and identified some of the ways technology can help bring it all together.

It’s also great to get a behind the scenes look into how real Uncat customers are experiencing the same kinds of challenges with uncategorized expenses and income… and overcoming those challenges with easy to use software.

👉 Make sure to get your copy of The Uncat Trends Report Ebook

Obviously we’re big on Uncat, and we’re also big on helping accountants and bookkeepers work effectively and not feel frustrated.

Being part of a community is important to any accounting professional or vendor, and we look forward to meeting people just like you in person at major accounting conferences. We’re always happy to see Uncat fans sharing the love, and one thing we’ve noticed is that once people start using Uncat, they really like it, and they tell other people about it (check out some of our reviews).

Here’s a sample…

“[Uncat] is amazing” ⭐️⭐️⭐️⭐️⭐️

“Using Uncat has made it so easy for us to get information from clients about transactions for which we have questions. Clients find it super easy to use as well.” - Amy R - Senior Accounting and Tax Consultant

“Simple solution to a common headache!” ⭐️⭐️⭐️⭐️⭐️

“Like most accountants, I find myself sending a spreadsheet full of questions to my clients at the end of each period. Waiting for these responses typically creates a bottleneck every month. With Uncat, I'm able to get those answers in real time rather than being forced to wait for a client to track down the answers days or weeks after EOM.” - Kevin F

In addition, we’ve been fortunate to be featured in news articles, we’re included in the QuickBooks App Store, and our Xero connection welcomes a whole new community to Uncat.

Learn more in this roundup of Uncat News: Updates, Mentions, and More.

It’s also great to partner with leaders and influences in the accounting space to talk about uncategorized transactions and help their audiences see the benefit of using a more modern approach to solving an old problem. Take a look at Accounting Webinars and More with Uncat to see some of our recent forays, and watch this really cool dive into Uncat with our friend, Jason Staats:

Bonus: We’re Introducing the Uncat Referral Program

Refer a friend and you’ll both get a free coffee!

Conclusion

Wow. Thanks for sticking around, we hope this resource helped you nail down the basics and move forward with a better understanding of uncategorized transactions.

While we’re at it, make sure to check out our free, on-demand demo, book a live call anytime, or start a free trial.