Two Ways to Manage Uncategorized Expenses: A Side by Side Comparison

Estimated Reading Time: 3 minutes

There are usually a few ways to address a problem.

We tend to lay these out as options, and we gravitate toward the option with either the biggest payoff or the least amount of friction. Pro tip: Follow a numerical sequence for laying out options instead of mixing letters and numbers 😆.

Except when it comes to managing uncategorized expenses.

Many accountants and bookkeepers are so used to doing this the hard way that it’s difficult for them to imagine a simpler, time-saving method that doesn’t involve a spreadsheet.

Let’s zoom in on two options for handling uncategorized expenses and deposits:

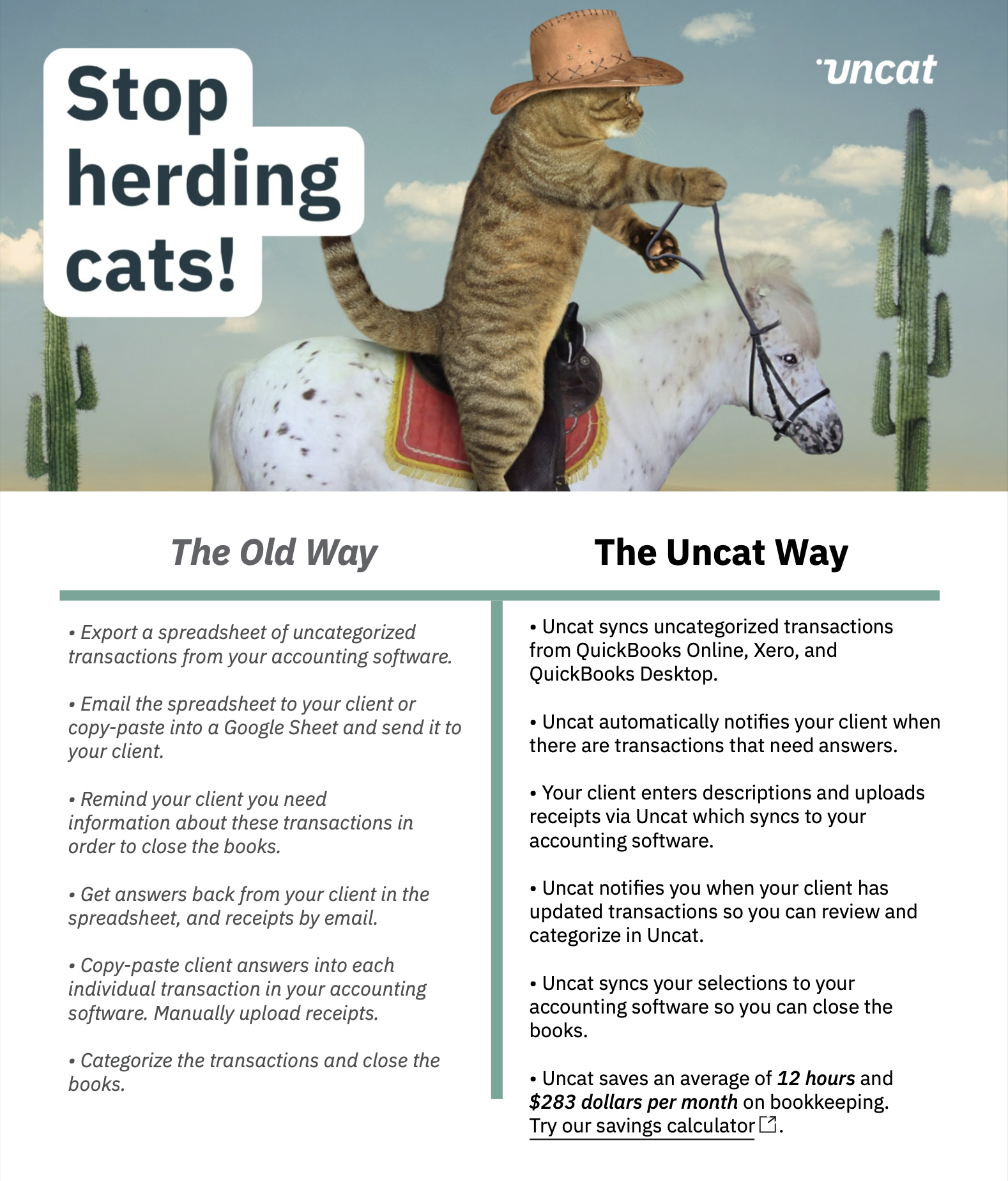

The Old Way

The fancy term for old is “legacy.” But we’re going to stick with old here because it feels more punitive and captures the pain of all the back-and-forth that’s involved in how uncategorized transactions are typically managed.

Is this how you’re doing it now?

Export a spreadsheet of uncategorized transactions from your accounting software.

Email the spreadsheet to your client, or copy-paste into a Google Sheet and send it to your client.

Remind your client you need information about these transactions in order to close the books.

Get answers back from your client in the spreadsheet, and receipts by email.

Copy-paste client answers into each individual transaction in your accounting software. Manually upload receipts.

Categorize the transactions and close the books.

For the record, we have nothing against spreadsheets. They’re great tools for the right jobs, but they just don’t excel (pun intended) at client communication.

There’s a better way.

The Uncat Way

What if something were built from the ground up, with accounting professionals in mind, that removed so much friction from this process that you were freed up AND your clients were happier?

Meet the Uncat Way for managing uncategorized expenses and deposits:

Uncat syncs uncategorized transactions from QuickBooks Online, Xero, and QuickBooks Desktop.

Uncat automatically notifies your client when there are transactions that need answers.

Your client enters descriptions and uploads receipts via Uncat, which syncs to your accounting software.

Uncat notifies you when your client has updated transactions so you can review and categorize in Uncat.

Uncat syncs your selections to your accounting software so you can close the books.

Uncat saves an average of 12 hours and $283 dollars per month on bookkeeping. Try our savings calculator.

Ditch the spreadsheet and start saving time

For just $9 per client per month, you could get out of the spreadsheet runaround, add hours back in for more productive work, delight your clients, and maybe cut out a little early next Friday.

Get started with a free 7-day trial today.