Build the Best Accounting Firm Tech Stack for your Business

Estimated Reading Time: 10 minutes

If your business is like most accounting firms, you likely offer a collection of services to meet the financial needs of your clients. From account reconciliations to payroll and financial reporting, you’re trusted to maintain a complex financial apparatus that is critical to the health of their business.

While much has stayed the same, many accounting firms have undergone a massive shift in technology adoption. The rise of digital natives, distributed workforces, interconnected sales and accounting systems, and the ability of businesses to operate asynchronously across time zones all point to a pressing need to build a solid tech stack at your accounting firm.

And with so much to juggle already, like chasing uncategorized expenses, many accountants and bookkeepers have a hard time dialing in the right mix of technology, integrations, software capabilities, sophistication, and getting all of that together at a price they can afford.

Working with the flow of business technology is important for modern accounting firms. If they’e not already running a tech stack, they’ll need to catch up quickly. In fact, client expectations have risen to a level that they are sometimes outpacing a firm’s ability to deliver interactive, instantaneous, or asynchronous experiences.

So where do you start? Or if you already have some of the pieces in place, how do you make it better?

There’s no one-size-fits-all answer because tech stacks need to match the needs of your business. Identifying core technologies like CRMs and general ledger software should be at the top of your list, but as your business evolves you’ll need to augment your stack with new or better solutions.

Before we dive in…

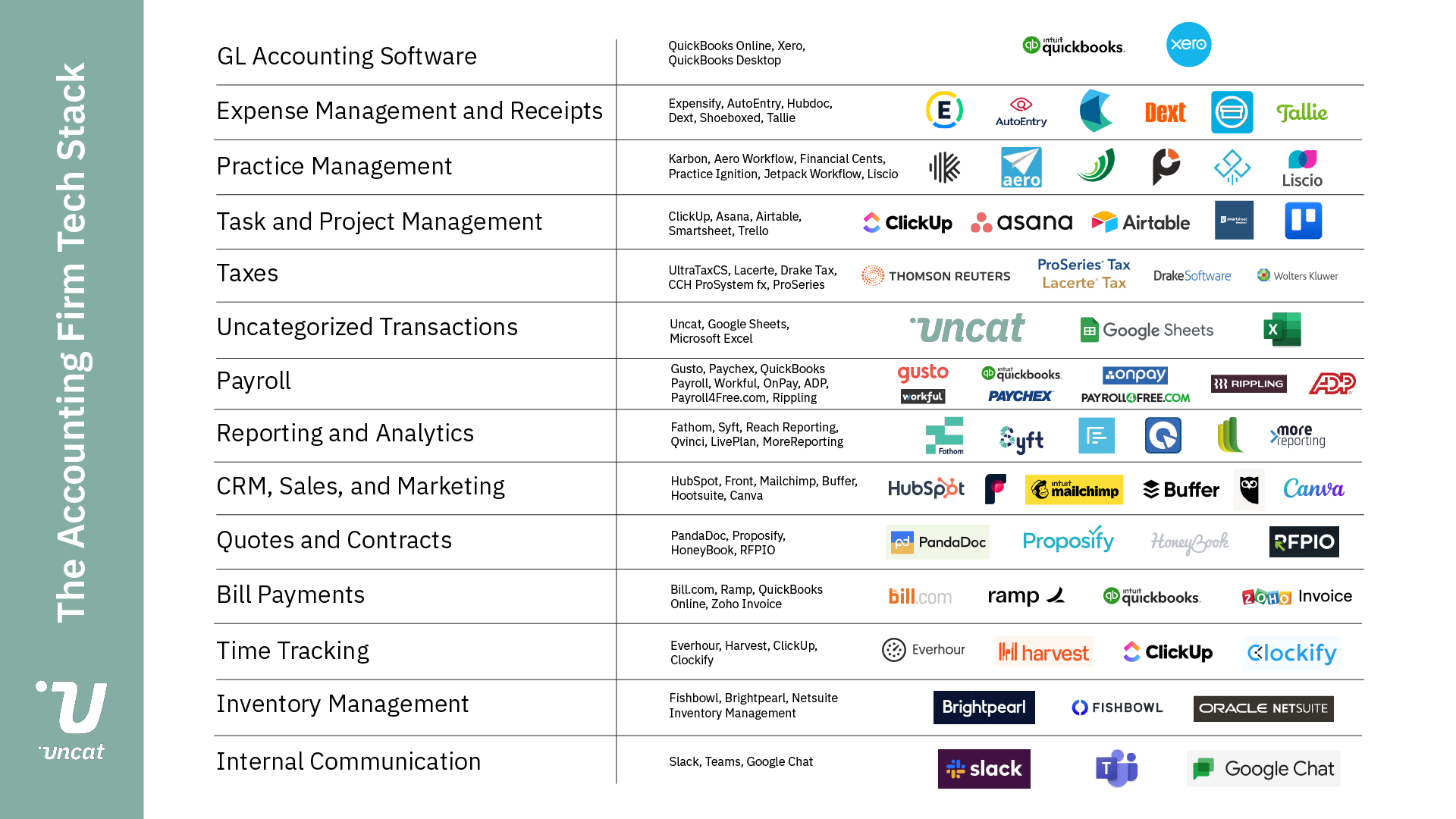

Remember to always do your own research 🎓 as you develop your tech stack, but regardless of where your business sits on this continuum, we think you’re bound to find some ideas in this roundup. Depending on how your firm operates and its access to resources, it’s helpful to visualize how some of the components fit together:

General ledger accounting software

Finding the best general ledger software for your tech stack could serve a dual purpose. Use it for your own books, and build capabilities to better serve clients who use the same tool.

QuickBooks Online is a powerful, simple cloud accounting tool that leads the pack in market recognition and general capabilities. Many businesses start here and stay here, so it’s a good idea to learn more about this tool.

Xero is great for SMBs as well as accountants and bookkeepers. It even offers practice management tools.

QuickBooks Desktop remains a tried and true general ledger software, but just like the name implies, it’s not a true cloud solution. That coffee spill may be the end of your best client’s books if you’re not careful.

Freshbooks is a good option as well with GL capabilities, invoicing, expenses, time tracking, payments, and more.

“Lessons Learned” from Two Roads President, Adam Slack on Building an Accounting Firm Tech Stack:

Slowly roll out new tech, it's very hard to change once you have implemented it.

Ask peers their experience, they typically love to share the good, bad, and ugly.

Always be looking for the best solution, software is rapidly developing and you never know what could be out there.

Confirmation bias is real. If you have warning flags that you don't like a software implemented, really deep dive into that.

Lean into software, it will drive your margins.

Expense management and receipts

Industry-recognized expense and receipt management tools like these keep clients on track to get you what you need for reconciliations, month-end close, and tax prep.

Also, Divvy (a Billl.com company) is a well known expense management tool, and remember that some GL softwares like QuickBooks Online can take care of these needs, too.

Don’t leave out Oracle’s NetSuite is a powerful enterprise-level solution for expense management, but for SMBs, implementing something like Expensify might make more sense.

Practice management

Karbon delivers “practice management with collaboration at its core.” With chat, workflows, and project management baked in, it might be a great hub for your growing firm.

A few more well-known contenders include:

Wolters Kluwer offers CCH® ProSystem fx® Practice Management that “provides for effective firm management, including time capture, billing and invoicing, accounts receivable, project tracking, forecasting and reporting.”

Canopy is a rising star on Capterra’s 2022 practice management shortlist, and Firm 360 is a Software Advice “Frontrunner.”

IRIS Star Practice Management needs little introduction as it’s a go-to tool for “medium and large accounting firms across the globe and over one third of the top 100 CPA firms.”

Check out the full G2 Grid here.

Behind the scenes with a QuickBooks Firm of the Future: What does the accounting firm tech stack look like at Two Roads?

Hubspot - Sales

Front - CRM/email

Clickup - Task Management

Everhour - Time Tracking

Uncat - uncat

QBO - General Ledger

Slack - Internal Com

Stacker - Quality Management

Aritable - General Database Management

Task and project management

If you want all the bells and whistles with almost unlimited customization capabilities, ClickUp might be your choice for project management (or even practice management) at your firm.

Asana is a well-known project management tool that strikes a good balance between customization and usability.

Airtable is highly customizable and has a decent following and should help you get on the same page with the rest of your team.

Smartsheet is essentially a cloud based spreadsheet that can be adapted for a variety of uses (like project management).

Trello is a great task and project management tool for you visual types who like to see work laid out on cards. You can drag and drop work into different stages of completion, collaborate, and get a high level view of how your firm is managing tasks instantly.

Reporting and analytics

Some general ledger softwares (e.g. QuickBooks Online) comes with robust, built-in reporting and analytics capabilities, but you may find yourself needing to explore more powerful options.

If you need something with more muscle, Sage Intacct may be a good option for businesses that feel they’re exceeding the capabilities of QuickBooks.

Check out these major players in reporting and accounting analytics:

For those that need detailed budget reporting for their classes and jobs (QuickBooks Online) or tracking categories (Xero), Calxa will do the job. Calxa can also deliver cash flow forecasts both for an individual company or consolidated across multiple files.

Domo and Tableau could also be good options if you’re working with enterprise-level clients.

Uncategorized transactions

How do you manage uncategorized transactions at your firm?

Do you do the spreadsheet-and-email-runaround like most accountants, bookkeepers, and clients do?

Tried and true, but honestly a little clunky and time-consuming, the process of downloading a Microsoft Excel Spreadsheet, sending it off, following up a few times, getting partial answers, and then using that sheet to communicate is usually how it’s done.

There’s a much better way. Uncat gets information about uncategorized transactions back from clients faster and synced with your accounting software.

Learn more, setup a demo, or start a 14-day free trial. Easy.

Quotes and contracts

Managing quotes, contracts, and approvals electronically could save you a lot of time and headaches. Here are a few popular tools:

Bill payments

Fees can quickly add up. Be your client’s hero by guiding them to the right bill payment software.

Using Bill.com could be a great tool for getting multiple clients into one software, saving you time and streamlining AP and AR processes.

Ramp offers card management and “real-time expenses and seamless receipt collection within minutes.”

QuickBooks Online - we’ve mentioned it a few times here. If clients are looking for a simple accounting experience with GL, expenses, and bill payments all in one place, this might be your best solution.

Zoho Invoice is an “online invoicing software that helps you craft professional invoices, send payment reminders, keep track of expenses, log your work hours, and get paid faster.”

Taxes

Nothing like a good Schedule C. Check out the following options from The Journal of Accountancy’s 2020 survey:

UltraTax CS from Thomson Reuters

Payroll

Here’s a solid roundup of payroll options from Investopedia to round out your accounting firm tech stack:

Best Overall: Gusto

Best Reporting: Paychex Flex

Easiest to Set Up: QuickBooks Payroll

Best Customer Service: Workful

Best for Small Businesses: OnPay

Best for Large Companies: ADP

Best Free Option: Payroll4Free.com

Best for Integrations: Rippling

Inventory management

Helping your clients effectively manage inventory sets them up for success and can make your job run smoothly as well. Explore these inventory management technologies to get started. Keep in mind there are usually options that may be tailored to serve one vertical over another.

Fishbowl pairs nicely with QuickBooks and Xero.

Brightpearl touts itself as a good option for retail and ecommerce businesses.

Netsuite Inventory Management “provides a single, real-time view of inventory across all locations and sales channels” for larger businesses.

CRM, sales, and marketing

If you’re looking for a true all-in-one solution with CRM, Sales, Marketing, Service, and CMS capabilities, Hubspot may be your best bet. You won’t get all the nuances you’d enjoy with bringing multiple solutions together, but you can’t beat the convenience and clarity of having everything in one place.

Front brings email, CRM and client portals together in one place. You can track customer satisfaction, and again, there’s something to be said for having multiple tools available in one SaaS app (that is a software as a service application - you gotta know this stuff if you’re going to be an accounting firm tech stack whiz 😸).

Mailchimp is a great tool if you’re looking for a basic email tool for newsletters, one-off emails, list management, email campaigns, and more.

Buffer or Hootsuite can help you take your firm’s social media capabilities to the next level with scheduled posting and reporting. Spice up your images with Canva to set your firm apart.

Time tracking

Gotta get paid. Track time in the cloud (and even integrate time tracking and project management) for greater efficiency. Here are a few options to choose from for your accounting firm tech stack.

Internal communication

Slack is hands down the most popular internal communication tool of all time. Give it a shot, but watch out for the junior bookkeepers in your office who may be tempted to waste billable hours on selecting the perfect GIF.

Teams is a popular video, voice, and chat app that integrates nicely with Microsoft’s O365 solution. It’s free.

Try Google Chat if your firm is already using Google Workspace (formerly G Suite).

There’s more to explore

Building the right tech stack at your accounting firm might take some time as well and trial and error, but it’s worth it. Technology is always changing. Make sure to thoroughly investigate your options, get some advice, and bookmark this blog as a helpful resource.

Take Uncat for a spin! Start your free 14-day trial today.