The Top 10 Bookkeeping Infographics

Estimated Reading Time: 6 minutes

Bookkeeping is an essential and unavoidable aspect of any business—whether large or small.

Being responsible for keeping an organized, logical record of a business’s financial transactions and even reporting and advising the business based on its finances is a huge task to bear on your shoulders.

With the help of infographics, this daunting challenge isn’t as scary or unapproachable. When bookkeeping infographics are easy-to-follow, creative, and informative, they can present appropriate information that alleviates many of the burdens of the bookkeeping profession and improves yourself as a bookkeeper and individual.

At Uncat, we’ve put together a list of our top 10 bookkeeping infographics. And although you could get lost down a rabbit hole of bookkeeping and financial infographics, we made this list as a first step to dip your toe in the water and get you hooked on infographics (because we are!).

Whether you’re need new resources to use in your practice or are looking into what the future of the bookkeeping profession looks like, you’re in the right place. Keep reading for Uncat’s top 10 bookkeeping infographics.

Bookkeepers vs. Accountants

Do you want to pull your hair out when people assume or incorrectly label you as an accountant?

Well, don’t lose all of your hair too quickly, as this infographic is a great, quick illustration of the basic differences between accountants and bookkeepers.

You might want to bring this one home to friends and family who can’t seem to keep the record straight (pun intended). You can finally show people in an easily legible way that not everyone with an accounting degree is automatically an accountant.

History of bookkeeping

Are you a bookkeeper but unfamiliar with the history of your profession?

In this ancient-looking infographic, Intuit and QuickBooks outline how accounting and bookkeeping have existed for centuries, all the way back to the first civilization—Ancient Mesopotamia.

A lot of professionals, though they may love their job, have little knowledge of the origins of their industry/field. So, use this infographic to acquaint yourself with a few of the most influential points in accounting and bookkeeping history.

Starting a bookkeeping business

Want to start your own virtual bookkeeping business?

Look no further as this infographic by QuickBooks Chat walks you through seven steps to establish your virtual bookkeeping business.

Owning your own business is empowering and exciting, but actually creating a start-up can be a frightening and stressful endeavor. However, this infographic provides simple steps to guide you through some of the initial phases.

If you’re considering a bookkeeping business or if you know someone who is, hold onto this infographic.

Bookkeeping mistakes

In general, infographics often advise you on what actions you should take or what you need to do to achieve a goal.

However, this infographic cautions you on what you should NOT do by listing six common bookkeeping mistakes you should avoid. For example, not keeping a record of finances and not reconciling your books each month are huge mistakes bookkeepers make that damage them in the long run.

(Tip: Uncat is a great solution to help with keeping a record of your books and with reconciliation. By providing a one-click access app for you and your clients to categorize and organize transactions, you can easily and quickly get information from your clients to help with recording transactions and reconciling books without wasting time with spreadsheets or chasing your clients down.)

Benefits of bookkeepers

Need a little extra boost to nail down client onboarding?

This infographic lists six reasons why bookkeepers are essential to every business, regardless of what industry they’re in.

Without an organized record of financial transactions, businesses will collapse. And this is where bookkeepers like you come in!

Use this infographic to show your potential clients multiple reasons how bookkeepers can help them and their business and why they’re so highly valued.

Bookkeeping terms cheat sheet

This cheat sheet is an amazing resource for anyone in the bookkeeping industry.

Whether you’re an experienced veteran bookkeeper, a recent graduate, or a fresh hire, this bookkeeping cheat sheet is a great way to ensure your understanding of key accounting and bookkeeping terms and concepts (accounts receivable/payable, assets vs. liabilities…).

Have an intern or new hire? Give them this cheat sheet to help weave them into the industry.

Success tips for bookkeepers

Unlike the six common bookkeeping mistakes, this infographic gives you five tips on how to be a successful bookkeeper.

Specifically, we find numbers two and four to be especially important.

Number two—having a strong relationship with your client—will go miles to help your bookkeeping business’ success and reputation in the long run. Word of mouth about strong business-client relationships can be one of the most profitable avenues to increase your business. And number four is key to being a competent bookkeeper.

(Tip: Uncat can help you be an organized, competent bookkeeper by allowing you and your clients to exchange information easily and categorize any uncategorized transactions or missing transactional information).

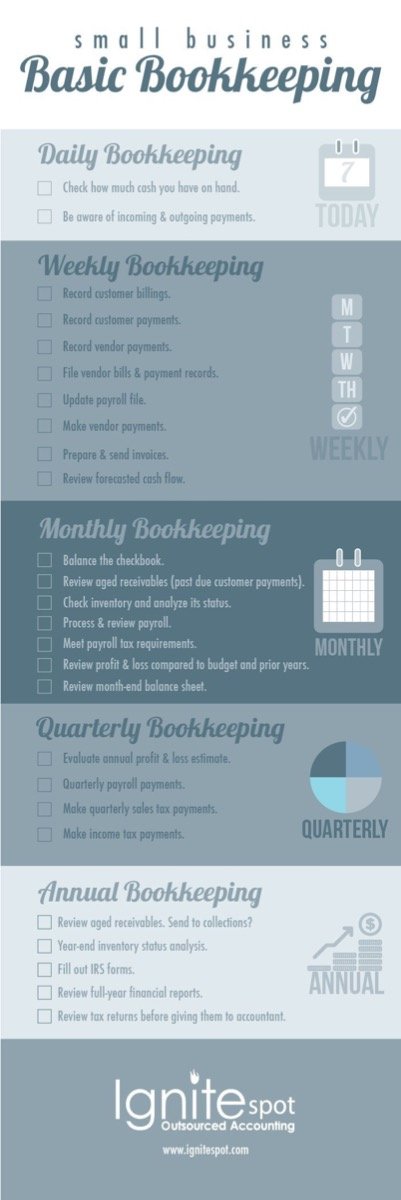

Bookkeeping checklist

Do you or your clients occasionally forget to file vendor bills each week or review all aged receivables each month?

Well, this infographic is the perfect fit for you because it provides a checklist of tasks to complete.

We love this infographic because it provides an extensive list of what you, as a bookkeeper, should be doing throughout the year—daily, weekly, monthly, quarterly, and annually.

Other infographics might divide these up, but this infographic conveniently provides this all in one location. Use this infographic to ensure you don’t forget any bookkeeping tasks.

Common deductible expenses

Are you unsure which expenses qualify as deductibles for your business?

Since all deductible expenses for businesses must meet the IRS definition of ordinary and necessary, determining which are deductible can be overwhelming or taxing.

With so many potential deductible expenses, use this infographic—which lists eight common deductible expenses (office supplies, advertising and marketing)—to help guide your bookkeeping and analysis of a business’s expenses.

Double-entry bookkeeping basics

This infographic is another great infographic for fresh hires into the bookkeeping industry or recent graduates.

It breaks down the basics of double-entry bookkeeping into a few frequently asked questions (FAQs).

Double-entry bookkeeping, when combined with all the reporting and submission requirements businesses have, can sound complicated for those unfamiliar with the process of bookkeeping.

But understanding the principles behind double-entry bookkeeping will boost your confidence in keeping your clients’ books, so be sure to share this with your new hires or those entering the bookkeeping industry!

And that’s Uncat’s top 10 list of bookkeeping infographics! We hope you might find at least one (or more) of these infographics constructive and fruitful for you or someone you know.

Did you read these infographics and not see one you like or one of your favorites? Feel free to suggest an infographic to us, as we could always use another infographic in our lives.

Ready to optimize your bookkeeping abilities and improve your communication with your clients? Sign up for your free 14-day Uncat trial, and see how Uncat can improve your bookkeeping practices for the better.