The Top 10 Bookkeeping Books

Estimated Reading Time: 9 minutes

The life of your bookkeeping business or profession depends on how well you can manage your client’s finances and investments.

Starting a business might sound simple enough, but running a business is not a walk in the park for everyone. Whether it’s a startup or a well-established business, you should have a basic knowledge of all the important bookkeeping terms.

If you want to learn the basics of finance and bookkeeping, one of the best ways to gain knowledge is by referring to the massive collection of different bookkeeping books out there, and there are a lot.

So, we’ve narrowed down the extensive list of bookkeeping books to Uncat’s top 10 bookkeeping books. We’ve got a variety of different bookkeeping topics in this list, so continue reading to find the best bookkeeping books for beginners, those looking to start their own bookkeeping business, or those wanting to improve their client relationships.

Learn Bookkeeping in 1 Day

(Best for beginners)

This e-book, authored by Krishna Rungta, is an excellent choice for beginners in the bookkeeping industry.

No prior bookkeeping experience or knowledge is required to read and understand this book. Rungta uses real-life scenarios to walk you through how you could apply your memorized knowledge to the real world.

The exhaustive step-by-step walkthrough of bookkeeping and accounting combined with the technical jargon simplification, this beginner bookkeeping book will leave you feeling prepared, understanding bookkeeping and accounting principles, as well as how to apply them to your business or your clients’ businesses.

Bookkeeping Made Simple

(Best for beginners)

David A. Flannery, the author of Bookkeeping Made Simple, removes the confusion surrounding bookkeeping and financial jargon for beginners to bookkeeping and students. By reading this book, you’ll have a deeper understanding of how to use numbers and why they are vital in bookkeeping.

Some of the topics Flannery dives into include closing the books, individual accounts, partnership, assets and equities, and controlling cash. In a workbook format, this book will ensure you walk away with a better grasp of bookkeeping—whether you’re interested in being a bookkeeper or just need the basics for yourself.

Bookkeeping All-In-One For Dummies

(Best for beginners)

Bookkeeping All-in-One for Dummies is part of the dummies franchise, which transforms difficult topics or concepts into easily digestible and easy-to-use information.

This specific book, written by Ita Epstein and John A. Tracy, provides the fundamentals of bookkeeping for the average reader. There is no technical jargon obstacle to worry about overcoming.

By incorporating common language in laymen’s terms that comprehensively covers the necessary information, you can learn about new programs and bookkeeping techniques, managing assets and liabilities, reporting profits, tracking transactions, double-entry bookkeeping, and understanding financial statements. The book even includes references and illustrations to augment your learning experience. It’s your go-to guide for all things bookkeeping.

Full Charge Bookkeeping

(Best for intermediates)

Nick J. Decandia’s book, Full Charge Bookkeeping, is a great book for beginners and intermediates in the bookkeeping industry.

Decandia highlights the different types of businesses, their sizes, and how they work and function. By including a brief overview of the basics of bookkeeping and accounting (financial statements, general ledger, payroll, accounts payable/receivable) and also diving into advanced bookkeeping topics, this book bridges the gap between bookkeeping knowledge and application. For example, by reading this book, you can apply the bookkeeping lessons you’ve learned to help you land a bookkeeping job!

However, it’s important to note that this isn’t a textbook, nor is it overly detailed. So, it might be best to read it after you’re acquainted with bookkeeping concepts or use it as a supplement.

The book also contains resources like a study outline and testing material to help you master the information and skills, but it also has resources like new job checklists and master calendars that you can use daily as a bookkeeper.

Bookkeeping Essentials

(Best for practicing bookkeepers expanding their bookkeeping business)

As a bookkeeper, you’re sure to be busy with new tasks every day: daily checking and adding transactions, filing vendor bills, reviewing aged receivables each month, contacting your clients for information, and preparing for a month-end close.

This book aims to advance your skills to reach an intimate understanding of bookkeeping, ideally becoming a better bookkeeper than you were before you read this. Bragg analyzes bookkeeping challenges, pinpointing what you should look for, and how to solve them. Through the challenges the book presents, the book also highlights how bookkeepers are important and valued, so you can feel more confident in yourself and your job, in turn becoming a better bookkeeper.

Check out this book if you’re a practicing bookkeeper searching for ways to better your practice.

The E Myth Bookkeeper

(Best for those wanting to start a bookkeeping business)

This book is for a more specific audience of bookkeepers: those looking to start their own bookkeeping business.

Authors Michael E. Gerber, Roberts Debbie, and Peter Cook talk about what causes many bookkeeping practices to fail and how you can avoid this when you start your bookkeeping business. This book guides you through the process of starting your bookkeeping business from scratch. Even though starting a business seems intimidating and impossible on your own, especially when combined with the tasks and responsibilities you already have, this book offers an outline to create a self-sufficient, profitable, and expanding bookkeeping business.

E-Z Bookkeeping

(Best for beginners or bookkeepers needing a refresher)

This introduction to bookkeeping can be used by beginners to bookkeeping, students, or bookkeepers needing a refresher (on journals, ledgers, financial statements) to reference throughout their work. It functions as a workbook with quizzes after each chapter to reinforce the information and determine how much you’ve learned.

However, this book isn’t as comprehensive as some of the others on this list. By primarily highlighting small bits of daily bookkeeping practices through realistic problems and examples, it serves as more of a supplement to a textbook or another bookkeeping book.

But, it’s supplemental material frequently used in classroom settings to teach and refresh students on basic accounting and bookkeeping knowledge. This book, by Kathleen Fitzpatrick and Wallace W. Kravitz, is an approachable, straightforward resource on bookkeeping fundamentals.

Bookkeepers’ Boot Camp

(Best for small businesses)

This book, by Angie Mohr, is a fantastic resource to illustrate the importance of having a bookkeeping system or a bookkeeper in your business and how bookkeeping intertwines with businesses. Sharing the information you garner from this book with clients and potential clients is a great way to promote your business and the relevance of the bookkeeping industry.

But the book is also helpful for small bookkeeping businesses or bookkeepers working with small businesses to recognize how to best use and organize financial information to grow business and achieve success. The book covers in detail topics such as starting a business, bookkeeping, tracking financial information, and leaving a business.

It’s a great starting point or a refresher for those with a bookkeeping background and/or a background working with small businesses.

How to Win Friends and Influence People

(Best for bookkeepers looking to improve their professional relationships)

While this book isn’t specifically tied to bookkeeping, we think it’s particularly useful for those in the accounting and bookkeeping industry.

Dale Carnegie writes about how you can improve your professional and client relationships. Topics include handling complaints, encouraging clients to see your point of view, improving your influence and reputation, as well as becoming a better listener, speaker, and salesperson.

Reading this book as a bookkeeper will help you win over more clients by earning their trust, respect, and loyalty. As we all know, word of mouth about a business is one of the most powerful ways to earn or lose business and profits. This book would serve any bookkeeper well when it comes to giving clients financial advice and interacting with clients. But, it’s even more advantageous to read this book when its contents apply to pretty much any other area of your life too.

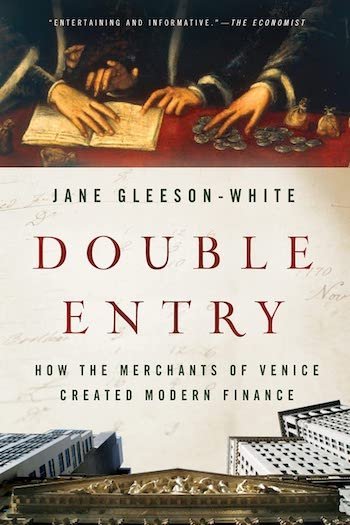

Double Entry: How the Merchants of Venice Created Modern Finance

(Best for bookkeepers interested in finance and bookkeeping history)

This book is a perfect read for accountants and bookkeepers alike (and even non-accounting or bookkeeping professionals).

Author Jane Gleeson-White discusses the origins of accountancy and capitalism, which helps put into context where we are now in the United States and Europe. By traveling back to 7,000 B.C. and leading up to the 2008 economic crisis, this book is an interesting historical tale with valuable insights applicable to your practice.

The book even won a literary award—the Nib Waverly Library Award for Literature—in 2012, which exemplifies the great storytelling and captivating writing style of this book (even for a book with accounting/bookkeeping content).