Uncat is perfect for cleaning up uncategorized transactions with new clients

For accountants and bookkeepers, taking on a new client is an exciting opportunity to expand their business and help someone achieve their financial goals. However, before diving into the new client's finances, it's essential to clean up any past uncategorized transactions.

Why? Here are a few reasons why it's important for accountants to clean up past uncategorized transactions for new clients:

Accurate Financial Reporting: Uncategorized transactions can lead to inaccurate financial reports, making it difficult to assess the client's financial health. By cleaning up past transactions, accountants can ensure that financial statements accurately reflect the client's finances. This provides the client with a clear picture of their financial position and helps them make informed business decisions.

Tax Compliance: Properly categorizing transactions is crucial for tax compliance. If transactions are misclassified or not categorized at all, it can lead to underpayment or overpayment of taxes. By cleaning up past uncategorized transactions, accountants can ensure that the client is in compliance with tax regulations and avoid any penalties or legal issues.

Improved Efficiency: Cleaning up past transactions can also lead to improved efficiency for the accountant. By categorizing past transactions, the accountant can quickly identify any discrepancies and have a better understanding of the client's finances. This makes it easier to manage the client's accounts moving forward.

Better Client Relationships: A clean set of financial records can lead to a better client relationship. By providing the client with accurate financial reports, the accountant can build trust and establish themselves as a valuable asset to the client's business.

Cleaning up past uncategorized transactions is an essential step for accountants when taking on a new client. It ensures accurate financial reporting, tax compliance, improved efficiency, and better client relationships. By taking the time to clean up past transactions, accountants can set themselves and their clients up for success.

Uncat is a favorite tool for accountants and bookkeepers to do client clean ups

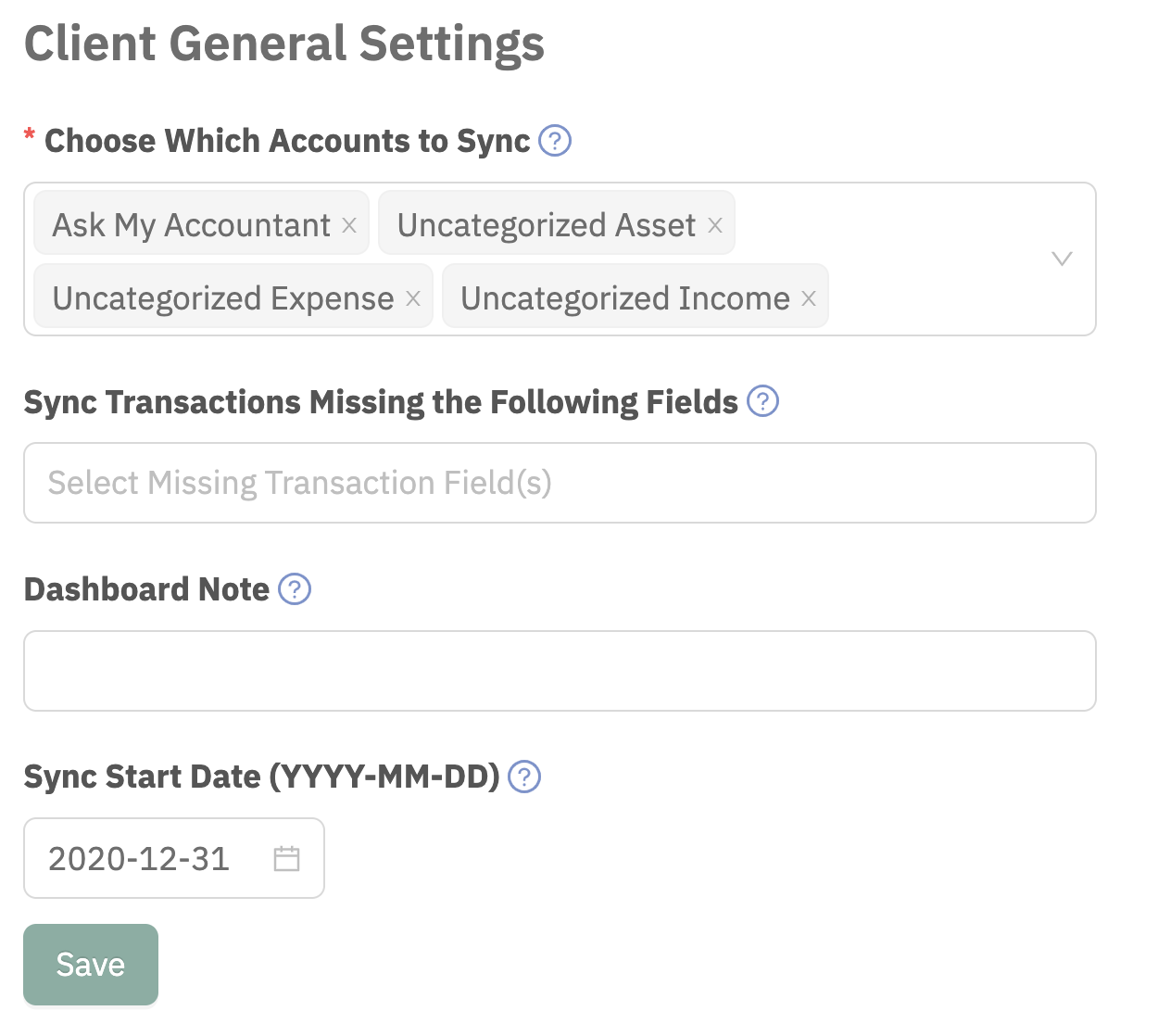

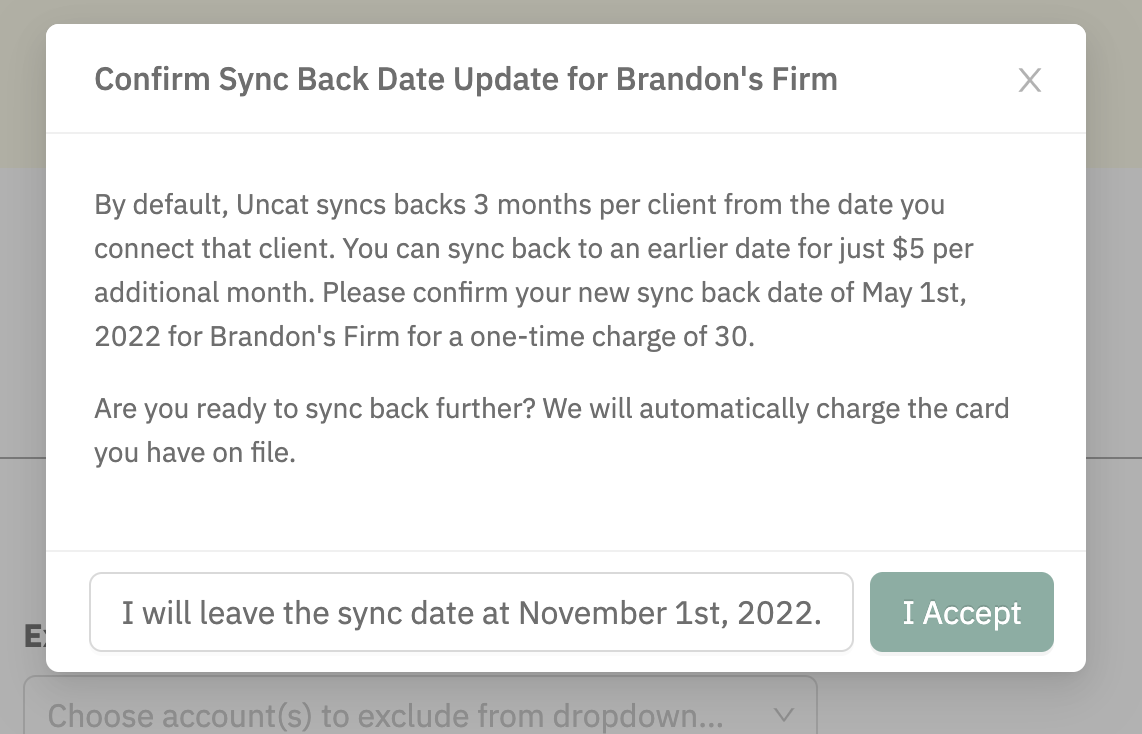

When you add a new client to Uncat, Uncat will sync back 3 months by default. If you want to sync back further to do some additional cleanup, it's just $9/month. You can choose the Sync Start Date you want for any client in Client Settings. Please note that if you’re closed the books, Uncat will only sync back to the close date. If you need to clean up transactions prior to the close date, simply re-open the books and then you can close them again when your clean up is complete.