Stop Wasting Hours in Excel: A Smarter Way to Categorize Business Expenses

It’s 1985, the sun is shining, and we’re in our brand-new Camaro, driving into the era of fax machines, pagers, and floppy discs: state-of-the-art tools revolutionizing businesses. That same year, Microsoft Excel is released, offering a sleek and powerful way to manage financial records. Fast-forward to nearly 40 years later: fax machines are obsolete, pagers have vanished, and floppy discs are museum pieces. Yet, one relic of that era still dominates finance teams today: Excel.

Don’t get us wrong; we appreciate a well-sorted Excel sheet. However, no matter how many updates, it’s still a tool designed for the 90s. Today, manually sorting expenses in Excel is slow, prone to errors, and frustrating to scale. As businesses grow, so does the complexity, making month-end closings in Excel longer and way more cumbersome than they need to be.

With growing transaction volumes, stricter compliance requirements, and the shift to remote operations, automation is becoming a necessity. Fortunately, smart solutions are right at your fingertips. Let’s walk you through them.

The Real Cost of Using Excel for Expense Categorization

Businesses stick with Excel for expense categorization because it feels familiar, which is the usual reason for relying on outdated tools (hello, USB flash drives), but that familiarity comes at a cost.

Finance teams spend up to 24 hours per month manually updating and verifying spreadsheets. That’s nearly three full workdays lost to a process that could be automated.

Human error rates in manual data entry range from 1% to 5%, leading to misclassified expenses that distort financial reports and increase tax liabilities. As a result, 94% of spreadsheets contain critical errors, yet most businesses don’t catch them until they cause larger discrepancies. And it matters: just one missed miscategorized transaction can skew a financial report, inflate tax liabilities, or cause compliance issues that take even longer to fix.

The inefficiencies compound as businesses scale. More transactions mean more spreadsheets, creating version control issues, reconciliation delays, and increased audit risks. Relying on Excel for expense categorization is a financial and operational bottleneck that slows growth and increases risk.

Bottom line: Using Excel means working longer hours, making more mistakes, and ultimately leaving money on the table.

Breaking Down the Excel Method: Why It’s a Hassle

Back in the 1980s, Excel, just like fax machines, pagers, and Camaro, felt like a revolution. It streamlined tasks that were once entirely manual and handwritten. But despite updates and efforts, just like other relics, it hasn’t aged well for today’s fast-paced finance workflows.

Here’s what categorizing expenses in Excel actually looks like:

Download transactions from multiple bank accounts—but wait, they’re in different formats. Bank statements come as PDFs, credit card reports as CSVs, and third-party platforms have their own exports.

Manually categorize each one—except vendor names aren’t always clear, and some transactions need extra context. Hope you don’t have to guess!

Chase down missing details—send emails, leave voicemails, and maybe even text your client. Then wait. And wait. And follow up. And wait.

Reconcile transactions—realize that some amounts don’t match because they were entered differently across sources, because (have we mentioned this before?) people make mistakes.

Deal with last-minute client follow-ups—because, oops, so sorry, someone always finds a “forgotten expense” after you’ve already closed the file. Glad they found it, but still annoying.

As you can see, it’s not just tedious; it’s chaotic. Each platform has its own date formats, naming conventions, and quirks. Some exports are missing categories; others split single transactions into multiple lines, and it’s up to you to piece everything together.

The result? Hours lost sorting through mismatched data, fixing errors, and waiting for client replies. Using Excel for expense categorization today is almost like storing all your business files on CDs: technically possible but painfully slow, counterintuitive, and completely unnecessary.

How Uncat Transforms Expense Categorization

Expense categorization shouldn’t be an endless cycle of manual entries, email follow-ups, and mismatched spreadsheets. Uncat makes the process faster, more accurate, and easier to manage by automating transaction requests, simplifying client input, and keeping everything in one place. Here’s how it works.

Automated Transaction Requests: No More Follow-Ups

Tracking down missing expense details takes time. Instead of sending reminders manually, Uncat automates transaction requests, so expenses get categorized without extra effort.

Requests are sent automatically when transactions need details.

Clients receive clear notifications with exactly what’s missing.

Built-in reminders keep the process moving without repeated follow-ups.

Accountants save hours each month by eliminating back-and-forth emails and unanswered messages. With everything handled in one system, there’s no need to chase details.

Magic Link for Clients: No Logins, No Hassle

Logging into portals, resetting passwords, and navigating complicated software slows everything down. Uncat simplifies the process with a one-click magic link that lets clients categorize transactions instantly.

No passwords, no extra steps—just a direct link to their transactions.

Works on desktop and mobile, so they can respond wherever they are.

The interface is straightforward, making categorization quick and accurate.

With fewer barriers, clients respond faster and with fewer errors, keeping expense tracking smooth and efficient.

Real-Time Sync With QuickBooks and Xero

Copying and pasting data between tools increases the chance of mistakes. Uncat syncs directly with QuickBooks and Xero, keeping everything updated in real-time.

No need to manually export and import transactions.

Expenses update instantly, reducing reconciliation time.

Transactions stay accurate and consistent across platforms.

With everything connected, accountants can work with the most up-to-date information instead of dealing with outdated spreadsheets.

A Centralized, Easy-to-Use Dashboard

Sorting through multiple spreadsheets and email threads to track expenses takes up valuable time. Uncat brings everything into one clean dashboard where transactions, client responses, and outstanding tasks are easy to manage.

View all uncategorized expenses and client updates in one place.

Avoid version control issues—everyone works with the latest data.

Businesses close books X% faster by streamlining categorization.

With everything structured and accessible, expense categorization becomes a smooth, efficient process instead of a time-consuming task.

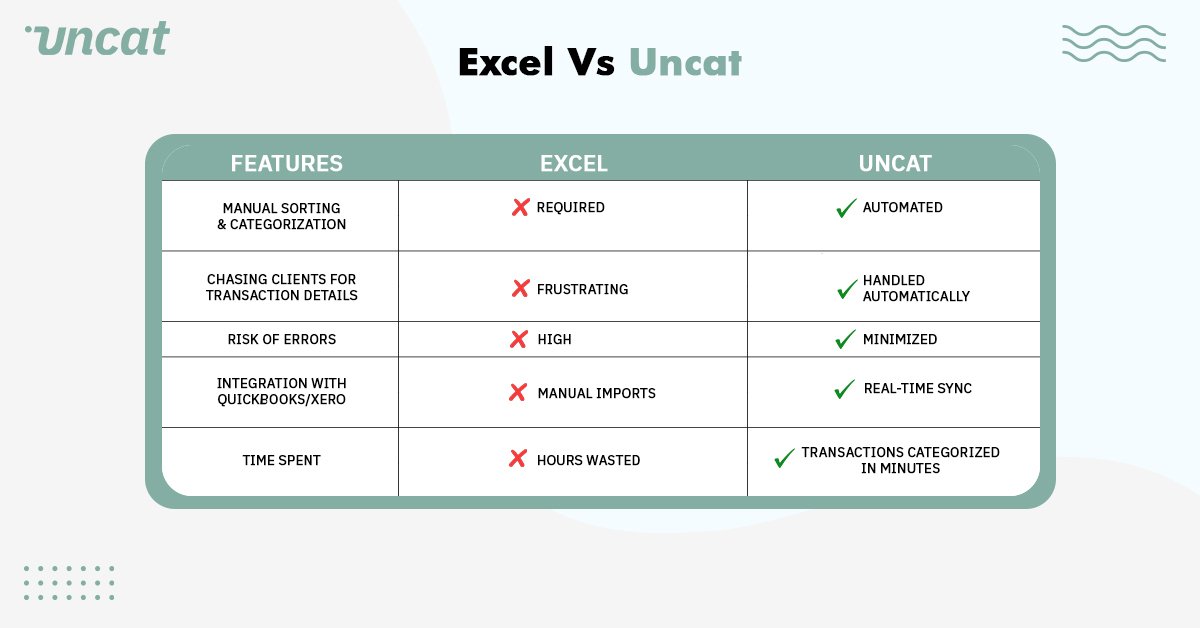

Excel vs. Uncat: a side-by-side comparison

Conclusion: Save Hours, Reduce Hassle, and Close Books Faster

Long story short, stop romanticizing the 80s and get your sheet together. Expense categorization doesn’t have to be a manual, time-consuming mess. Excel was a breakthrough when it launched, but today, it slows businesses down with manual data entry, version control issues, and endless client follow-ups. Automating the process means fewer errors, faster responses, and real-time syncing with QuickBooks and Xero.

Uncat simplifies expense categorization by automating transaction requests, giving clients a hassle-free way to respond, and keeping everything organized in one place. The result? More accuracy, less stress, and hours of time saved every week. For you and the entire firm.

Sure, we can keep the 80s Camaro—it’s timeless. But outdated processes? Those need to go. Try Uncat today and see how much faster and smoother your workflow can be.